Importance of Critical Illness Insurance | Health Insurance in Singapore

Health Insurance | Insurance

by Priyadarshini

16 February 2022

by Priyadarshini

16 February 2022

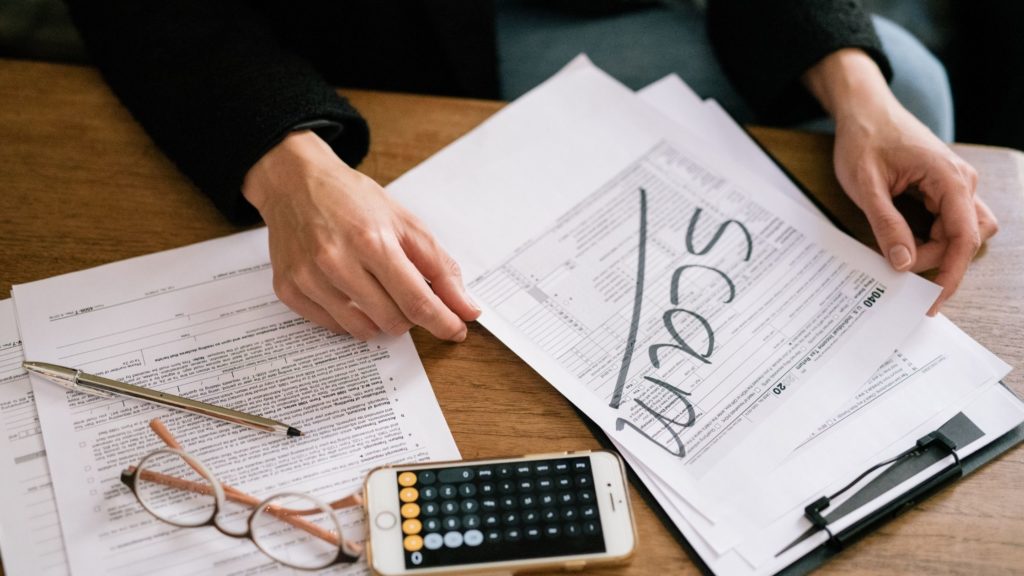

When a serious disease strikes, medical expenses aren’t the only thing to be concerned about. The long road to recovery may result in severe financial stress, such as income loss and childcare-related costs. At first look, ordinary Integrated Shield plans may appear to shield us financially against costly medical bills if our health is ever jeopardized. In this blog, we tell you about the importance of critical illness insurance.

However, according to the Life Insurance Association of Singapore’s (LIA) 2018 Protection Gap Study, the average Singaporean working adult only possesses $60,000 in critical illness coverage. In comparison, LIA recommends CI coverage that is four times the average yearly salary of $81,663, or roughly $316,000.

Furthermore, according to the findings of a recent Great Eastern consumer survey, nearly 40% of Singaporeans who have never been diagnosed with CI are unwilling to pay more for a greater coverage insurance plan – even if it gives superior protection.

Importance of Critical Illness Insurance

What exactly is Critical Illness (CI) coverage?

In the event of a certain critical illness diagnosis, CI insurance offers policyholders a lump sum compensation. This payment could potentially compensate for any coverage gaps in your current health insurance plans. CI will normally cover Singapore’s most major killers, such as cancer, strokes, and heart attacks, depending on the coverage. In this manner, your financial situation will not be jeopardized while you seek therapy and recuperate.

What happens if you have a critical disease and are underinsured?

Exorbitant medical bills and income loss

According to the Great Eastern consumer study, more than 80% of critical illness patients and caregivers regretted not purchasing enough insurance cover. As they increasingly rely on insurance reimbursements to cover expenses, 30% of them face medical bills totaling more than $250,000.

Be concerned about when CI will attack again

Over half of individuals who are now suffering CI expect it will not be the first time. With more than three-quarters willing to pay higher premiums if it meant increased protection against more CIs, as well as potential relapses in the future.

Reasons why you should get CI coverage sooner rather than later (Importance of Critical Illness Insurance)

Even if you are young, the critical disease might strike at any time

You may be asking why there is such a rush. If you’re still in your prime, CI might not be at the top of your priority list. However, current statistics suggest that CI can strike at any time, even decades before retirement. According to the National Registry of Diseases Office, the number of young people diagnosed with cancer is on the rise, notably among teenagers as young as 15 and adults as old as 34.

Multiple stages of critical illness are possible

As our life expectancy rises, it is possible that we may need to account for the long road to recovery. According to survey results, nearly 39 percent of persons with CI ceased working for more than a year, resulting in huge economic loss. By starting your CI protection sooner, you will not only be able to get a better insurance premium, but you will also be able to get enough protection and ongoing coverage while you work on getting back on your feet.

A critical sickness may hit you more than once in your life

This may be difficult to consider, but it is not uncommon for relapses to occur numerous times in a person’s life, especially now that we are living longer lives. According to a study conducted by the Ministry of Health and the University of Washington, a Singaporean born in 2017 could live for up to 84.8 years and spend 10.6 years of his life in bad health. This is especially disturbing because we don’t usually imagine that CI and the time spent seeking treatment and recovering will take up such a large portion of our lives.

Home Loan | Education Loan | Personal Loan | Car Loan | Travel Insurance | Lifestyle | Real Estate | Career